Virtual Credit Card Market Size

💳 Virtual Credit Card Market: Industry Perspective

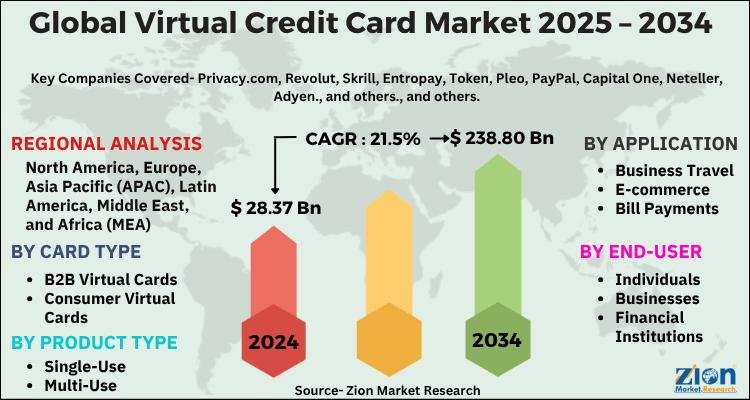

The global virtual credit card market size was valued at USD 15.73 Billion in 2024 and is expected to reach USD 56.72 Billion by 2034, expanding at a CAGR of approximately 13.86% between 2025 and 2034.

Virtual credit cards (VCCs) are digital versions of physical credit cards that offer enhanced payment security, faster transactions, and seamless integration with online platforms. With the increasing demand for secure e-commerce transactions and the rising adoption of contactless payments, the virtual credit card market is experiencing rapid growth across industries and geographies.

Access a Sample Report with Full TOC and Figures @ https://www.zionmarketresearch.com/sample/virtual-credit-card-market

🌐 Virtual Credit Card Market: Overview

Virtual credit cards are issued by financial institutions and are designed to protect users against fraud by generating unique card numbers for each transaction. They are primarily used for online purchases, subscriptions, and corporate spending management.

These cards offer significant advantages including:

Improved payment security

Reduced risk of identity theft

Simplified expense tracking

🔍 Key Insights

CAGR (2025-2034): 13.86%

Market Size: USD 15.73 Billion (2024) → USD 56.72 Billion (2034)

Top Growth Driver: Surge in e-commerce transactions

Leading Application Segment: Consumer payments

Top End-user Segment: Corporate

Regional Leader: North America

🚀 Virtual Credit Card Market: Growth Factors

Boom in E-commerce & Online Subscriptions – With consumers increasingly shifting to online shopping and digital services, VCCs have become a preferred payment method.

Focus on Cybersecurity – Rising cases of online fraud are pushing both consumers and businesses towards secure payment options like virtual cards.

Corporate Adoption – Businesses are leveraging VCCs for controlled employee spending, supplier payments, and travel bookings.

⚠️ Virtual Credit Card Market: Hindrances

Limited awareness in developing regions

Compatibility issues with certain merchants

Lack of physical usability in offline environments

🌈 Virtual Credit Card Market: Opportunities

Integration with digital wallets and mobile banking apps

AI-powered fraud detection systems

Expansion in emerging markets with growing internet penetration

Want to know more? Read the full report here: https://www.zionmarketresearch.com/report/virtual-credit-card-market

🗂 Virtual Credit Card Market: Segmentation

By Card Type:

Single-use Virtual Credit Cards

Multi-use Virtual Credit Cards

By Application:

Consumer Payments

Business Payments

By End-user:

Corporate

Individual

🌍 Virtual Credit Card Market: Regional Analysis

North America holds the largest market share due to high digital payment adoption rates and strong banking infrastructure.

Asia-Pacific is expected to record the fastest growth during the forecast period, fueled by booming e-commerce, increasing smartphone penetration, and supportive government regulations for digital finance.

🏆 Virtual Credit Card Market: Competitive Landscape

Leading players include American Express, Mastercard, Visa Inc., JPMorgan Chase & Co., Citibank, Revolut Ltd., Stripe, PayPal Holdings Inc., Marqeta Inc., and HSBC Holdings plc. These companies are investing heavily in AI-driven fraud prevention and cross-border payment solutions.

📌 Conclusion

The global virtual credit card market is set to expand rapidly over the next decade, fueled by the dual forces of digital payment adoption and heightened cybersecurity needs. With opportunities in emerging economies and advancements in payment technologies, market players are well-positioned to capitalize on the evolving landscape of secure, cashless transactions.

Click On This Below Link to See Similar Reports :

Civil Aviation Market: https://www.zionmarketresearch.com/report/civil-aviation-market

Flexible Paper Packaging Market: https://www.zionmarketresearch.com/report/flexible-paper-packaging-market

Scaffolding Market: https://www.zionmarketresearch.com/report/scaffolding-market

Mass Spectrometry Market: https://www.zionmarketresearch.com/report/mass-spectrometry-market-size

Dental Insurance Market: https://www.zionmarketresearch.com/report/dental-insurance-market-size

Asia Pacific Office

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

📞 US OFFICE NO +1 (302) 444-0166

📞 US/CAN TOLL FREE +1-855-465-4651

📧 Email: [email protected]

🌐 Website: http://www.zionmarketresearch.com

In addition to providing our clients with market statistics released by reputable private publishers and public organizations, we also provide them with the most current and trending industry reports as well as prominent and specialized company profiles. Our database of market research reports contains a vast selection of reports from the most prominent industries. To provide our customers with prompt and direct online access to our database, our database is continuously updated.

This release was published on openPR.