Foundry USA unexpectedly mined eight Bitcoin blocks in a row, a streak that stood out on explorers’ and social feeds. Controlling roughly a third of the network’s hashrate, the pool’s run was unlikely but still possible.

Summary

- Foundry USA mined eight Bitcoin blocks straight, from heights 910,500 to 910,507, in a run that grabbed crypto feeds.

- With roughly 36% of the network’s hashrate and about a 30% share of active pool activity, the odds of this streak were around 1 in 12,000 — but still within the realm of chance.

- The run shows how a few large pools can briefly capture multiple blocks in a row, underlining ongoing centralization concerns in Bitcoin mining.

A rare streak of eight consecutive Bitcoin (BTC) blocks — from heights 910,500 to 910,507 — briefly drew attention across feeds and block explorers. The repeated appearance of a single miner made the pattern hard to ignore. The consecutive blocks were striking: one mining pool, Foundry USA, appeared across eight entries in a row, the pattern that was so clear and easy to notice, that it quickly became the focus of attention.

Size matters

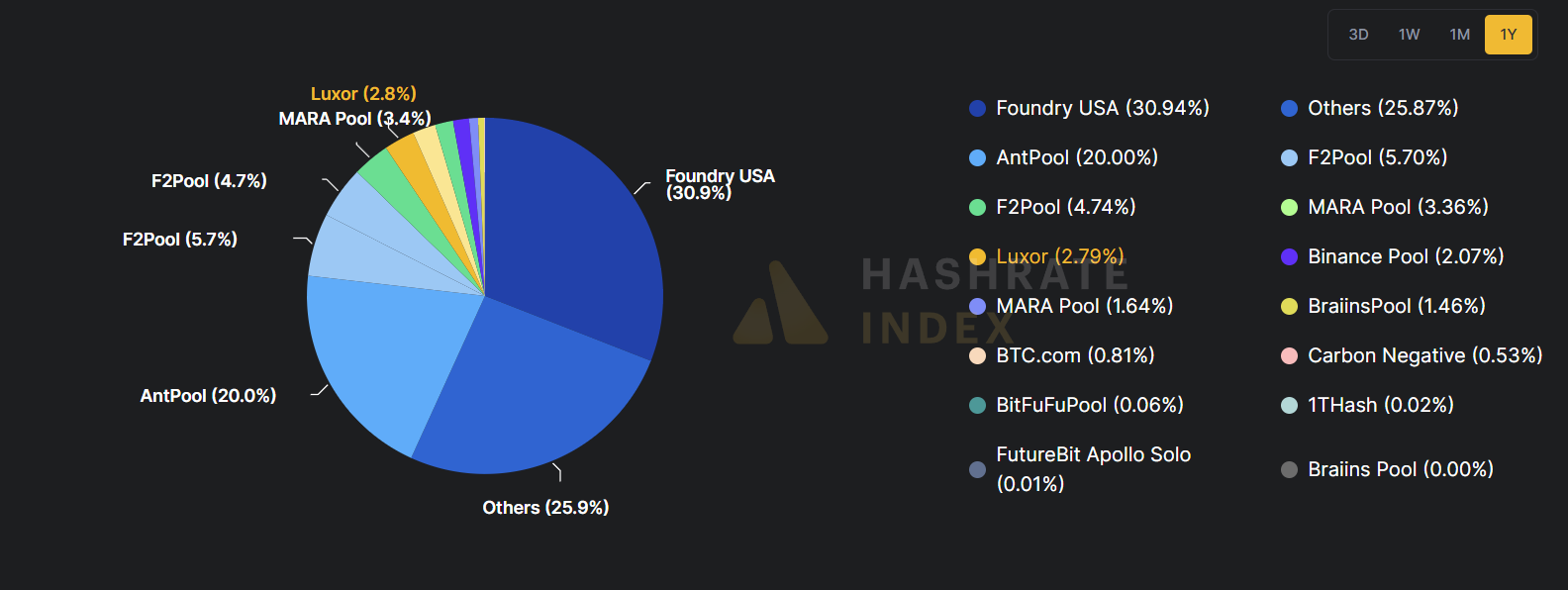

As of late 2024, Foundry USA controlled approximately 36.5% of the Bitcoin network’s total hashrate, translating to about 280 exahashes per second (EH/s). This dominance positions Foundry USA as the largest mining pool globally, surpassing competitors like Chinese Antpool and Luxor Pool.

Mining pools by their share | Source: Hashrate Index

As of press time, Foundry USA is reported to be one of the largest public mining pools, appearing on most trackers with roughly a 31% share of reported pool activity, per data from Hashrate Index. That reported slice meant Foundry USA was plausibly finding about three out of every 10 blocks on average in that period. The pool’s relative scale is the basic factual context that frames the streak as notable rather than inexplicable.

- A quick calculation using a ~30% pool share shows the odds of the same pool mining eight consecutive blocks are roughly 0.008%, or about 1 in 12,000.

In other words, the streak was rare but not unheard of. It looked like a lucky roll of the dice for a big pool, not a takeover of the network.

Low-fee backdrop

The run happened amid reports and block-explorer snapshots showing unusually low transaction fees and many lightly filled blocks in recent moments. Fee rates were often reported in low single digits of satoshis per virtual byte, and a number of recent blocks carried a relatively small number of transactions.

You might also like: Bitcoin miners may find better returns in AI than crypto, Novogratz’s Galaxy Digital suggests

In that environment, miner revenue leaned heavily on the fixed subsidy rather than on fees, and any miner that happened to capture several consecutive blocks would repeatedly collect the same standard subsidy while adding little extra fee income for each block.

Each of the eight blocks carried the familiar structural elements recorded across all mined blocks:

- a header;

- a coinbase reward;

- and whatever transactions happened to be included.

The notable detail in the public record was simply the repeated attribution to a single pool across successive heights. That repetition, visible in explorers and mempool logs, produced the clear data point that circulated: a contiguous range of blocks credited to Foundry.

Historical parallels

There were precedents for sharp public reactions when single pools approached large fractions of hashing power.

Earlier episodes in Bitcoin’s history drew similar attention when prominent pools dominated a large share of reported capacity. Those moments prompted public scrutiny and sometimes rapid responses from operators and the broader community. The chain continued to record its blocks in the same way through those episodes, leaving the public record as the primary evidence.

Seeing the same pool listed for eight blocks in a row looked striking because it gives the impression of concentrated power. That pattern made some worry about centralization, even though the math showed it was within the normal range for a big pool.

Foundry USA just mined eight blocks consecutively. This is extremely alarming! Even many Bitcoiners I know are starting to panic.

I’ve been warning people for years: Bitcoin is dangerously centralized. A tiny group of miners and insiders dominate both the network and its price,… pic.twitter.com/OOYo17X9Rn

— Jacob King (@JacobKinge) August 18, 2025

The episode settles into the larger flow of anomalies and attention cycles that regularly pass through the space. As CoinMetrics solutions engineer Parker Merritt wrote earlier, Bitcoin mining pool centralization remains a “top-of-mind concern in the Bitcoin community,” as even at face value, the overwhelming majority of mining rewards “being funneled to just two pools (Foundry & AntPool) elevates risk factors like censorship and network disruption.”

Read more: Bitcoin mining faces surging power demands and record-low fees