Cardano price is trading at $0.8697, with a modest 24-hour gain of 0.37%. Its market cap has inched up to $31.07 billion, while daily trading volume rose by 2.75% to $1.34 billion. With prices ranging between a low of $0.8465 and a high of $0.8752 in the last day, ADA’s short-term movement suggests consolidation.

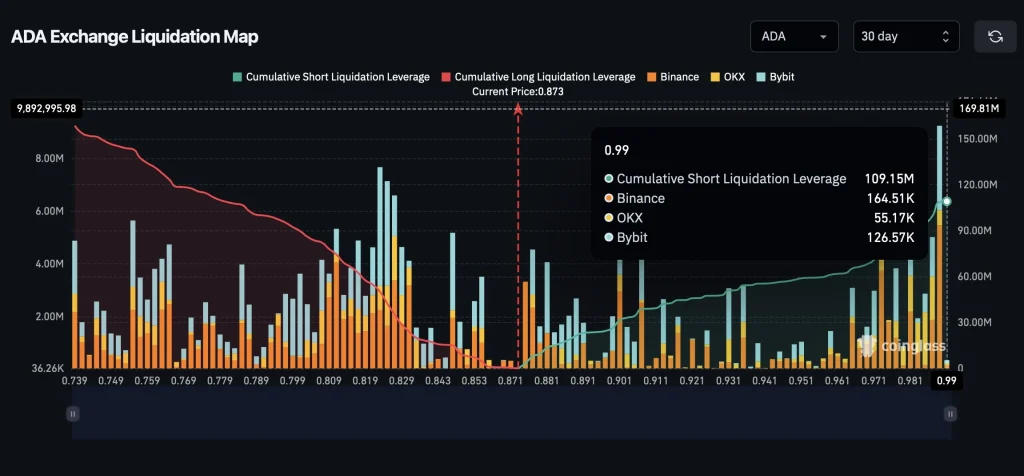

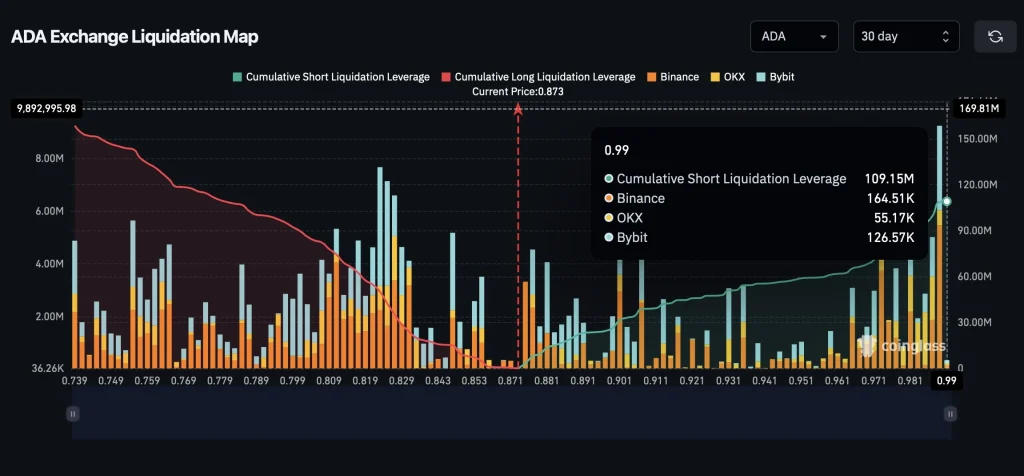

However, the on-chain signal shows a massive cluster of short positions, worth over $109 million, poised for liquidation if ADA climbs toward $0.99. So, wondering what your entry and exit zones are? Read this ADA price analysis for all specifics.

$109 Million Shorts to Liquidate?

The liquidation heatmap shared by indicates that the total short liquidations on major exchanges, including Binance, OKX, and Bybit, total ~$109.15 million near the $0.99 level. If the ADA price approaches this mark, traders holding leveraged short positions could face forced buybacks, creating upward momentum.

Exchange-specific data shows liquidation clusters at Binance ($164.5k), OKX ($55.1k), and Bybit ($126.5k). The concentration of short positions above current levels suggests that any bullish breakout could accelerate sharply if this liquidity zone is triggered.

ADA Price Analysis

The 4-hour chart shows ADA trading just below the midline of its Bollinger Bands, around $0.867. The upper band near $0.896 and the lower band around $0.824 define a narrow trading range. This is while the RSI reading near 49 indicates a neutral market with neither strong bullish nor bearish momentum.

Cardano price will need to stay above the $0.824 support region to avoid further downside pressure. Clearing the $0.896 resistance level could open the door for a test of the $0.99 price zone. A decisive breakout above that level would likely attract fresh buying interest, with the next target area falling between $1.022 and $1.20.

FAQs

It’s where $109M worth of short positions are at risk of liquidation, potentially fueling a price surge.

It signals a neutral market with no clear overbought or oversold condition, suggesting sideways price action.

Support lies near $0.824, while resistance is around $0.896. A strong move above these could send ADA toward the $1.022–$1.20 range.