Cardano price has shown renewed strength, trading at $0.8333, up 3% in the past hour. Its market cap now stands at $29.76 billion, while 24-hour trading volume has spiked nearly 40% to $1 billion. The price range for the day has been $0.7964 to $0.8314, highlighting a push toward the upper band of recent consolidation.

The surge follows rising optimism around Grayscale’s Cardano ETF application, where Polymarket data shows approval odds at 87% ahead of the October 26, 2025 decision deadline. Moreover, Cardano’s new “Ouroboros Leios” protocol has entered public review, signaling continuous development and attracting investor attention.

On-chain Metrics Indicate Growing Network Activity

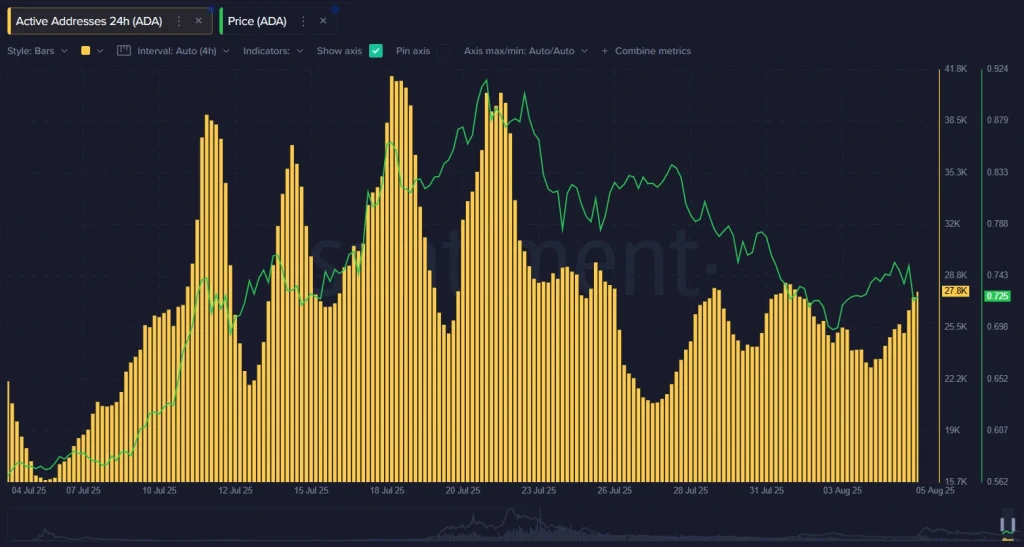

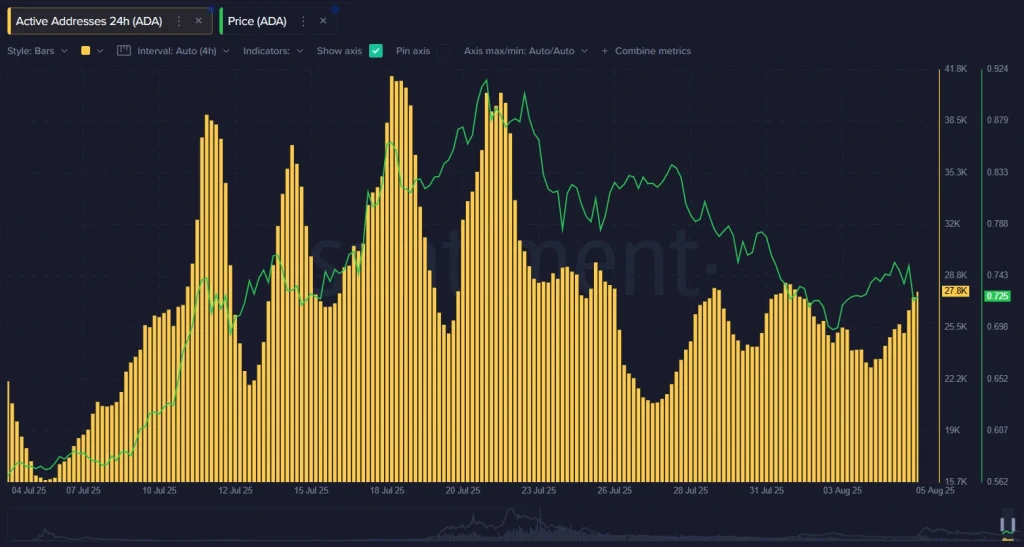

Santiment’s data shows a steady rise in active addresses, suggesting improving user participation. Address activity in yellow bars moves closely with ADA’s price action which is in green. Further confirming that the recent price action is backed by real network usage rather than speculative spikes.

Notably, active addresses have recovered from late July lows of ~19k to around 27.8k, matching ADA’s move back above $0.72. Historically, such increases in on-chain activity have preceded upward price momentum.

ADA Price Analysis:

On the 4-hour chart, ADA is trading near $0.844, with Bollinger Bands tightening, which is often a sign of incoming volatility. The RSI at 54 suggests neutral momentum with room for further gains before hitting the overbought territory. ADA’s immediate resistance sits just above the current price. While sustained buying pressure could drive the token to challenge the $1.022 level, and if that breaks, a push toward $1.20 may follow.

Support lies near $0.769, and holding above this level will be crucial to preserving the current bullish setup. If sellers gain control and ADA falls below this support, a deeper correction may follow. Conversely, if momentum continues and ADA price maintains its position above $0.80, buyers could attempt another leg higher toward $0.90 in the near term.

FAQs

ADA is gaining on ETF approval optimism and the public review of the Ouroboros Leios protocol.

The next key resistance sits near $1.022, with a broader target at $1.20 if momentum holds.

Yes, rising active addresses and strong trading volume confirm healthy network activity behind the move.