Native token of oracle network Chainlink (LINK) declined in tandem with the broader crypto market despite a fresh partnership with Japanese financial giant SBI Group.

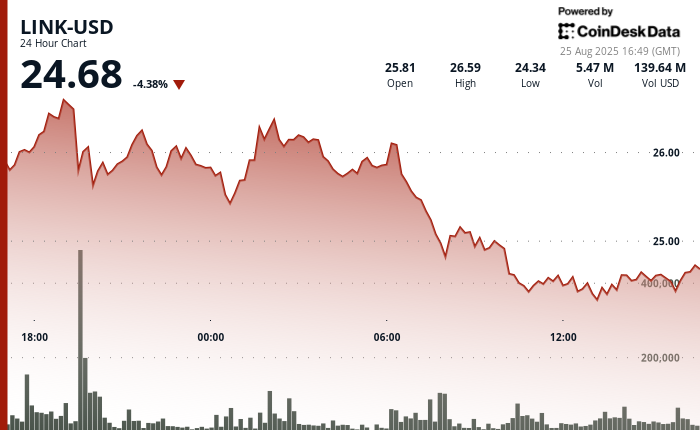

LINK declined to $24.4, down more than 6% over the past 24 hours, CoinDesk data shows. That’s a sharp reversal from the Friday’s year-to-date peak over $27.

The downward trajectory accelerated through successive trading sessions with persistent lower peaks, whilst the concluding hour exhibited stagnation with negligible volume, suggesting potential consolidation, according to CoinDesk Research’s technical analysis model.

On the news side, SBI Group, one of Japan’s largest financial conglomerates, said on Monday it has teamed up with Chainlink to develop tokenized assets and stablecoin solutions in Japan, with future plans to expand into other Asia-Pacific markets.

SBI will use Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to support transactions across different blockchains while maintaining compliance. The firms will also test tokenized funds by bringing net asset value data on-chain and explore payment-versus-payment settlement for foreign exchange and cross-border transactions. Chainlink’s Proof of Reserve will be used to verify stablecoin reserves.

SBI and Chainlink have previously collaborated under Singapore’s Project Guardian, a Monetary Authority of Singapore (MAS) initiative exploring blockchain use in finance.

Technical Indicators Analysis

- Resistance established at $26.61 with sharp reversal upon elevated volume activity.

- Critical support emerged at $24.37 with purchasing interest.

- Extraordinary volume of 7,850,571 units during peak volatility, substantially exceeding 24-hour average of 2,687,393.

- Systematic lower peak formations indicating bearish momentum acceleration.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.