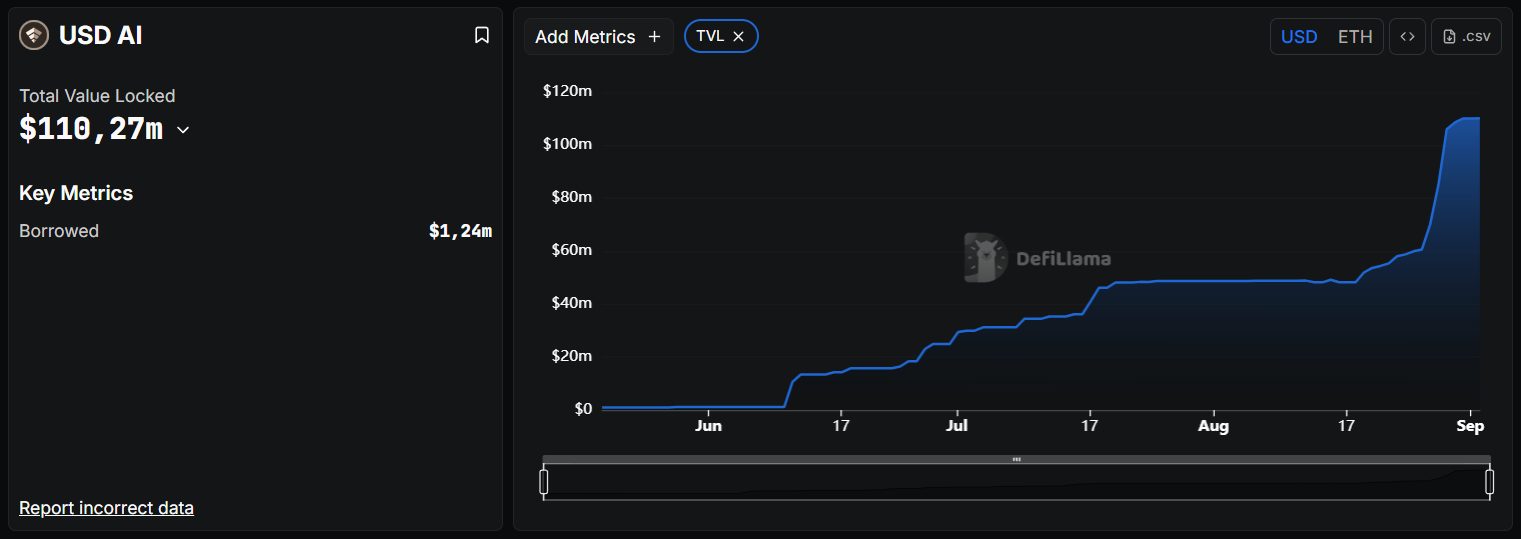

Stablecoin lending protocol USDai (USDAI) has nearly doubled in total value locked (TVL) since last week, jumping from around $60 million on Aug. 26 to cross the $110 million mark this weekend, per data from DefiLlama.

USDai TVL. Source: DefiLlama

On Aug. 26, YZi Labs, previously Binance Labs, the venture arm of the world’s largest crypto exchange, announced that it had made a strategic investment in USDai.

The project, developed by Permian Labs, consists of two tokens. USDai is an over-collateralized synthetic dollar, backed by GPU compute power and built to channel capital into AI infrastructure, per the project’s website. Holders can stake their USDai to receive another token, sUSDai, its yield-bearing counterpart, for a currently advertised APR of about 8%.

To encourage participation in the project’s initial coin offering, the team behind USDai created a rewards system dubbed the “Allo Game” that lets traders mint both USDai and sUSDai to earn points toward allocation for both the ICO and an airdrop.

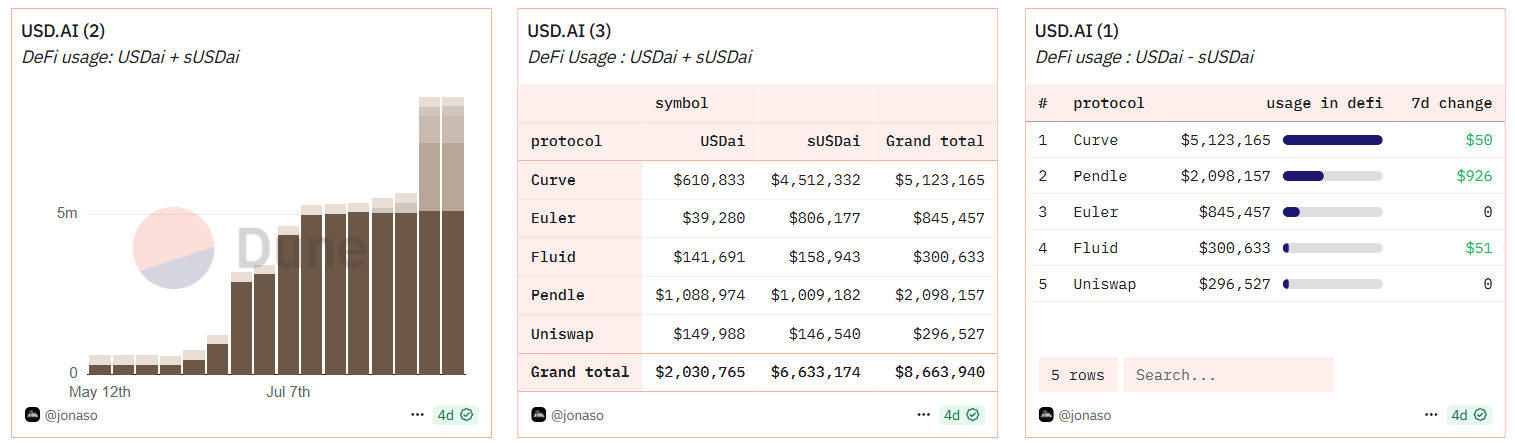

USDAI and sUSDAI DeFi usage. Source: Dune Analytics

According to Dune data, users have already locked over $5 million worth of USDai assets in Curve, another $2 million in Pendle, and more than $845,000 in Euler, meaning only around 15% of USDai’s total circulating supply is currently being used in DeFi.

In mid-August, USDai raised $13 million in a Series A round led by Framework Ventures, with backing from Dragonfly, Bullish, Arbitrum and others.