Aave (AAVE), a leading non-custodial liquidity protocol, has established itself as a major player in the decentralized finance (DeFi) ecosystem, controlling approximately half of the DeFi lending market share.

However, as the crypto market remains euphoric amid the broader bull run in 2025, several concerns within Aave emerge that could have severe consequences for the overall market.

The Risks Behind Aave’s DeFi Dominance and Market Control

According to data from DefiLama, Aave’s Total Value Locked (TVL) stands at $36.73 billion. This accounts for nearly 50% of the total $75.98 billion TVL. Furthermore, the protocol’s TVL reached an all-time high of $40 billion last week.

This dominant position makes Aave the ‘backbone’ of decentralized credit systems, enabling users to borrow and lend assets without intermediaries. Nonetheless, this central role also means that if Aave faces issues, it could trigger a ripple effect throughout the entire market.

But what could go wrong? One critical concern is the concentration of influence within the protocol’s governance.

Previously, Sandeep Nailwal, Founder and CEO of Polygon Foundation, expressed concerns about the governance structure within Aave. He highlighted that the protocol is governed by one individual (Stani Kulechov, the founder).

Nailwal noted that Kulechov has significant control over proposals and voting, effectively running the platform based on personal preferences.

“He also threatens the remaining voters to vote as per his proposals (whom i spoke personally after after Polygon proposal). This is when he already has a HUGE delegated voting power,” he wrote.

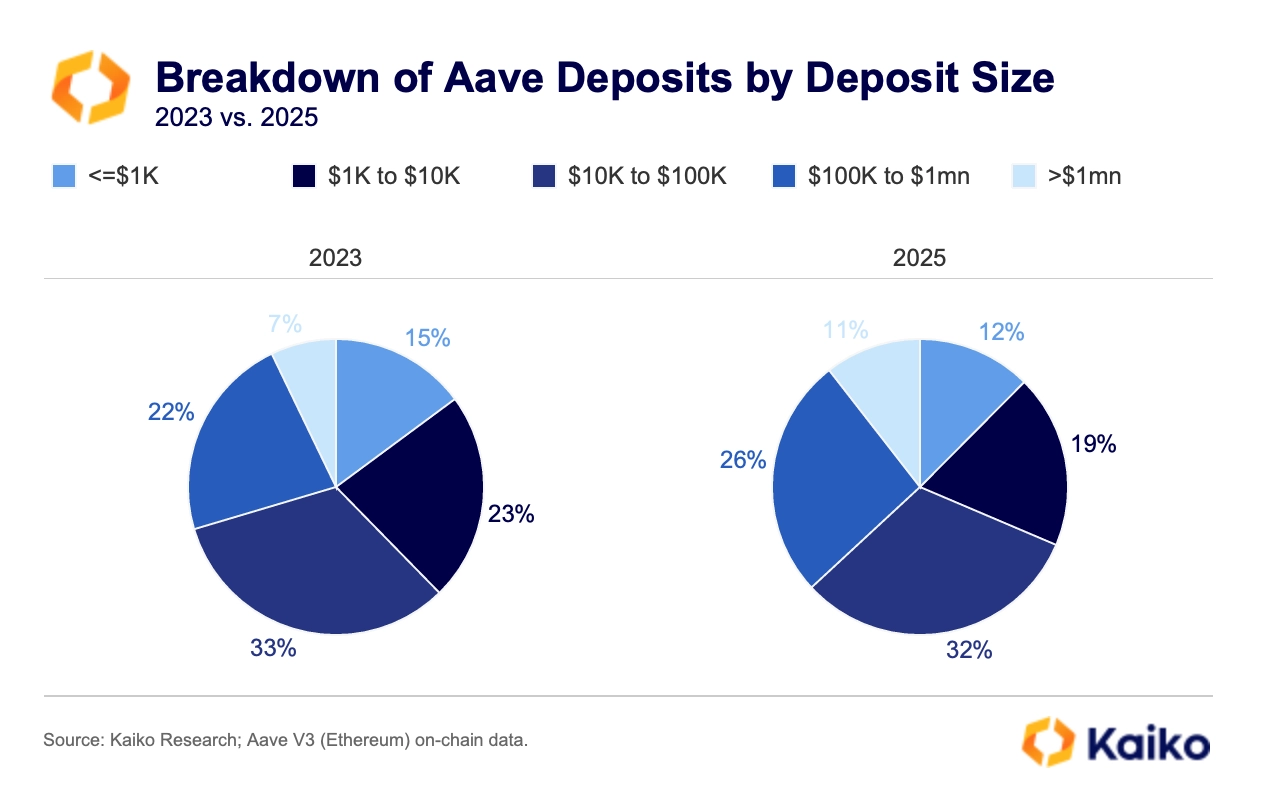

The user base composition further amplifies Aave’s vulnerabilities. Data from Kaiko Research indicated a shift in 2025, with large users holding collateral exceeding $100,000, rising from 29% in 2023 to 37%. Meanwhile, small users with deposits under $1,000 declined from 15% to 12% over the past two years.

“Users with over $100k in collateral grew from 29% in 2023 to 37% in early 2025, with the $100k–$1m collateral group rising to 26% and the $1m+ group to 11%, each up about four points. Over time, growth in large depositors has mostly come at the expense of smaller ones with $1k–$10k deposits,” Kaiko noted.

Aave User Concentration. Source: Kaiko Research

This concentration of power among high-net-worth participants heightens the potential for liquidity shocks and protocol instability. Should these users withdraw en masse or face liquidation events, the impact could reverberate across interconnected DeFi platforms.

Lastly, overexpansion also poses a significant risk. Aave’s deployment across 16 chains has strained operational resources. Defi Ignas, a prominent analyst, stressed on X that some of these expansions operate at a loss, increasing financial and technical risks.

“We reached an L2 saturation point: Aave deployed on 16 chains, but the new deployments are operating at a loss (Soneium, Celo, Linea, zkSync, Scroll),” the post read.

The implications of these risks extend beyond Aave itself. As one of DeFi’s most dominant players, any disruption, whether stemming from governance failures, user concentration, or over-expansion, could erode trust in decentralized lending and destabilize the broader ecosystem. Thus, addressing these challenges will be critical for Aave.

The post Is Aave on the Verge of Cracking Under Its Own DeFi Power? appeared first on BeInCrypto.