In brief

- Treasury Secretary Scott Bessent urged the Fed to consider a 50bps cut in September after weak job revisions and soft inflation data.

- July inflation came in at 2.7% year-over-year, slightly above expectations but reinforcing hopes for looser policy.

- Crypto markets rallied, with Ethereum hitting multi-year highs as traders priced in deeper rate cuts.

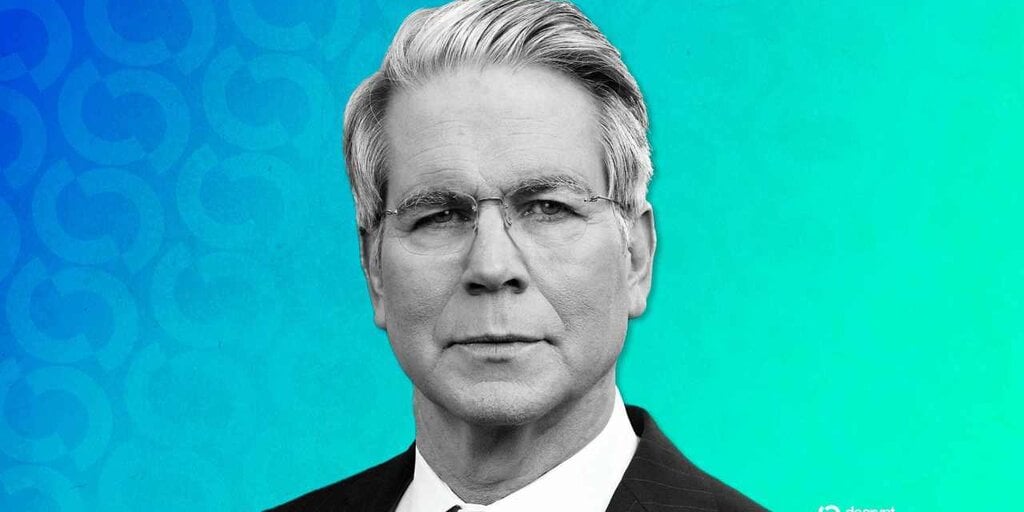

U.S. Treasury Secretary Scott Bessent said Tuesday a 50-basis-point rate cut in September should be on the table following “fantastic” inflation data, released this week.

Bessent said the U.S. Federal Reserve should consider cutting by half a point after the Bureau of Labor Statistics revised its employment figures for May and June downward by a combined total of 258,000 jobs.

President Donald Trump abruptly dismissed BLS Commissioner Erika McEntarfer, shortly after the bureau released its initial figures on August 1, accusing it of manipulating jobs data to undercut his administration.

“If we had the original numbers, we could have been cutting in June and July,” Bessent told Fox Business in an interview on Tuesday. “I think the real thing now to think about is: Should we get a 50-basis-point rate cut in September?” he said.

Lower rates reduce borrowing costs, encourage spending and investment, and push investors toward higher-yielding risk assets, often lifting markets, including crypto.

“A 50 basis point cut would confirm risk on for the rest of the year,” Ryan McMillin, chief investment officer at crypto fund manager Merkle Tree Capital, told Decrypt.

Speculation over deeper cuts comes as figures from the BLS showed July headline inflation rose 2.7% year-over-year, exceeding economists’ expectations by 10 basis points.

Crypto was quick to respond, with some blue-chip digital assets rising to their highest point in weeks, and Ethereum extending gains made earlier in the month to reach its highest point in years.

While odds for a 25-basis-point rate cut are now “locked in” for next month, according to McMillin, the Fed still needs to contend with another round of jobs and inflation data.

The prospect of a rate cut has bolstered past rallies fueled by ETF inflows, but trade developments, macro uncertainty, and seasonal trends could shift the market’s course.

Options activity shows crypto investors remain cautiously optimistic, with put buying still a dominant theme.

Positioning from traders hints at downside protection against the third quarter, which has generally displayed a median return of 0.96% over the past 12 years, Decrypt was previously told.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.